Overcoming Environmental Challenges in the MEA Lubricants Market

Environmental pressure in the Middle East and Africa (MEA) is often discussed in terms of climate targets and sustainability commitments. But for lubricant producers, traders, and end users in this region, the environment is not an abstract policy issue—it is a daily operating reality.

Extreme heat, airborne dust, water scarcity, infrastructure gaps, and waste-management limitations directly affect lubricant performance, equipment reliability, and total cost of ownership. In MEA, environmental conditions do not merely influence long-term strategy; they shape formulation choices, supply chains, and maintenance cycles today.

While our earlier analysis on future-proofing the energy industry explored structural change at a global level, this article focuses on a more immediate question:

How can the MEA lubricants market overcome environmental challenges and turn them into competitive advantage by 2025–2026?

In much of the Middle East and parts of Africa, ambient temperatures regularly exceed levels assumed in standard lubricant design models. Prolonged exposure to high heat accelerates oxidation, increases volatility, and shortens lubricant life.

For operators, this translates into:

As a result, demand in MEA increasingly favors higher-quality base oils with stronger thermal stability, including Group II, Group III, and synthetic blends. This is not about premium positioning—it is about operational survival.

This trend aligns with the broader global shift toward higher-quality base oils, but in MEA the driver is not regulation — it is physics.

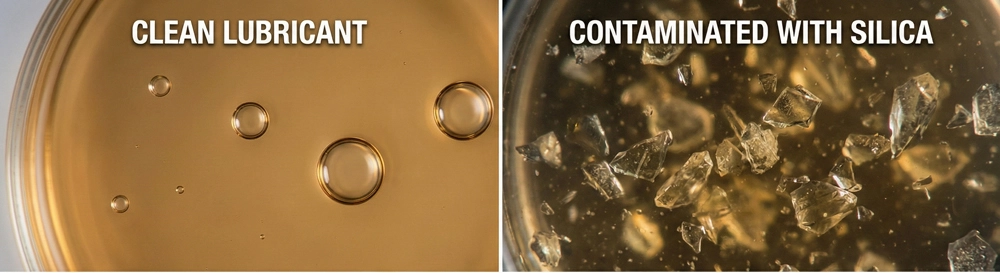

Airborne dust and sand are among the most underestimated environmental challenges in MEA. In mining, construction, power generation, and transport, particulate contamination dramatically increases wear rates and reduces lubricant effectiveness.

This forces operators to:

From a market perspective, this creates demand for lubricants with stronger detergency, dispersancy, and contamination tolerance, as well as more consistent base oil quality. In Africa especially, where operating environments are harsh and infrastructure uneven, lubricant robustness often matters more than brand or price.

Water is an increasingly constrained resource across MEA. This has implications beyond utilities—it directly affects cooling systems, metalworking fluids, and industrial lubricants.

Industries are moving toward:

This shift aligns with broader sustainability themes, but in MEA it is driven by resource availability, not just ESG reporting. The environmental challenge becomes a driver of product innovation.

Used oil management remains one of the region’s most pressing environmental challenges. In many MEA markets, collection systems are fragmented, and improper disposal still occurs—creating soil, air, and water pollution risks.

At the same time, this challenge presents a strategic opportunity. As discussed in our earlier article on circular energy models, re-refining can transform waste oil into a reliable, lower-carbon feedstock for base oil production.

In MEA, re-refining offers three critical advantages:

What is a regulatory obligation in Europe becomes a strategic asset in MEA.

New base oil capacity is coming online across Asia and the Middle East, particularly in Group II and Group III grades. While this supports supply growth, it also raises environmental expectations around emissions, energy efficiency, and waste handling.

Producers that combine modern process technology with environmentally aligned feedstocks—such as GTL or re-refined streams—are better positioned to meet both operational and sustainability demands. Capacity alone is no longer enough; how base oils are produced matters as much as where.

Unlike Europe, MEA does not operate under a single regulatory framework. Environmental policies vary widely by country, creating an uneven compliance landscape.

However, pressure is building from multiple directions:

Companies that wait for formal regulation may find themselves reacting too late. Those that proactively align with higher environmental standards gain market access, credibility, and flexibility.

The most successful players in the MEA lubricants market are reframing environmental challenges as strategic levers.

Key actions include:

As explored in our analysis of resilient energy strategies, adaptability—not scale alone—defines long-term success.

The Middle East and Africa present some of the world’s toughest operating environments for lubricants. Heat, dust, water scarcity, and waste challenges are not temporary obstacles—they are defining features of the market.

Yet these same pressures are accelerating innovation, improving product quality, and driving circular business models. For companies willing to adapt, the MEA region is not a risk to manage, but an opportunity to lead.

The future of lubricants in MEA will not be shaped by copying global solutions—but by engineering smarter, tougher, and more sustainable ones for local realities.